How to use the Manual

Quick Guide

Video Tutorial

Iceberg Features

In-depth analysis

Brokers

Data Feed

Other Manuals of beeTrader Trading Platform

How to use the Manual

Quick Guide

Video Tutorial

Iceberg Features

In-depth analysis

Brokers

Data Feed

Other Manuals of beeTrader Trading Platform

Aggiungi questa pagina al tuo libro

Aggiungi questa pagina al tuo libro  Rimuovi questa pagina dal tuo libro

Rimuovi questa pagina dal tuo libro

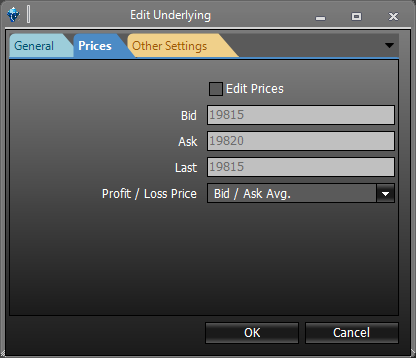

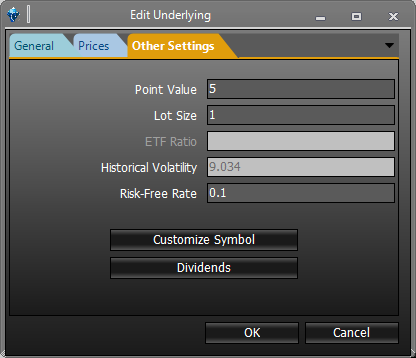

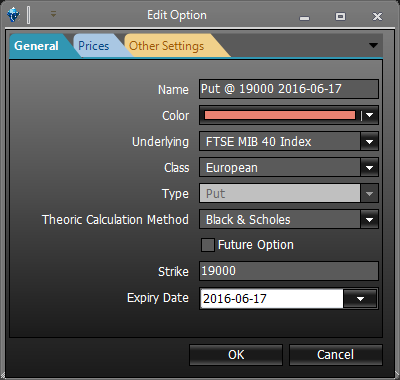

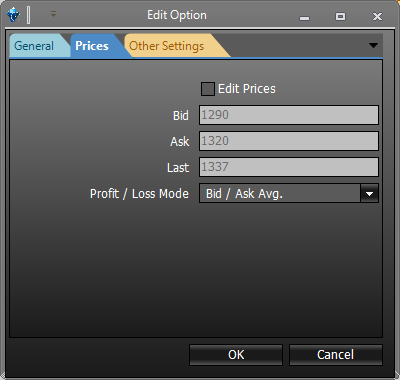

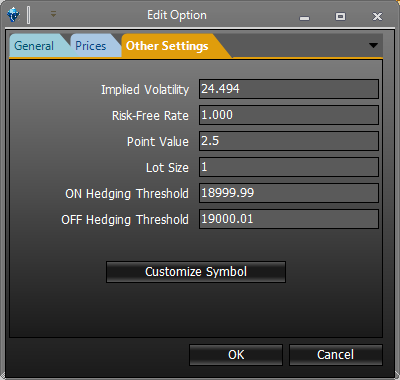

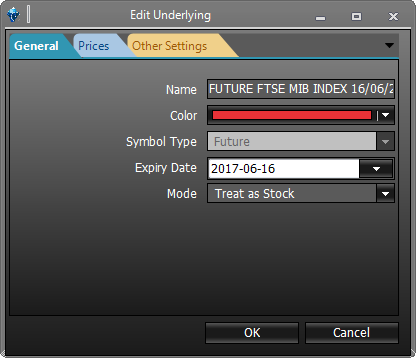

Depending on the type of instrument you want to edit (Edit) The Edit window is different, if you edit a futures o an underlying the window is named Edit Underlying, if you edit an option the window is called Edit Option .

All changes that will be made in Edit Option and Edit Underlying will be saved ONLY for the current strategy. If you want that your changes are saved permanently the change must be made in Symbol Manager.

It is recommended to make changes to the parameters that are in Edit Option and Edit Underlying only if you are sure of you are doing

The graphical representation of a future is not rectilinear since its value also changes with the passage of time. It is therefore a curve, very slightly marked but still a curve. This feature means that in the representations of payoffs combined with the options they have of curvilinear forms, and the calculations of maximum risk and maximum gain are related to the actual shape of the future. To avoid having payoff difficult to understand they are designed considering the future designed as if it were a stock, leaving the user to select any redesign in future arrangements.