How to use the Manual

Quick Guide

Video Tutorial

Iceberg Features

In-depth analysis

Brokers

Data Feed

Other Manuals of beeTrader Trading Platform

How to use the Manual

Quick Guide

Video Tutorial

Iceberg Features

In-depth analysis

Brokers

Data Feed

Other Manuals of beeTrader Trading Platform

Aggiungi questa pagina al tuo libro

Aggiungi questa pagina al tuo libro  Rimuovi questa pagina dal tuo libro

Rimuovi questa pagina dal tuo libro Questa è una vecchia versione del documento!

Tag: Weekly, Long Term, Leaps

Chain Iceberg Options is designed to be functional and customizable, the user has the option to choose how many strike, which and how many expires , what options to connect and what properties options are displayed. It is possible to save a configuration of settings.

You see below how to read the options chain and how to interact with it.

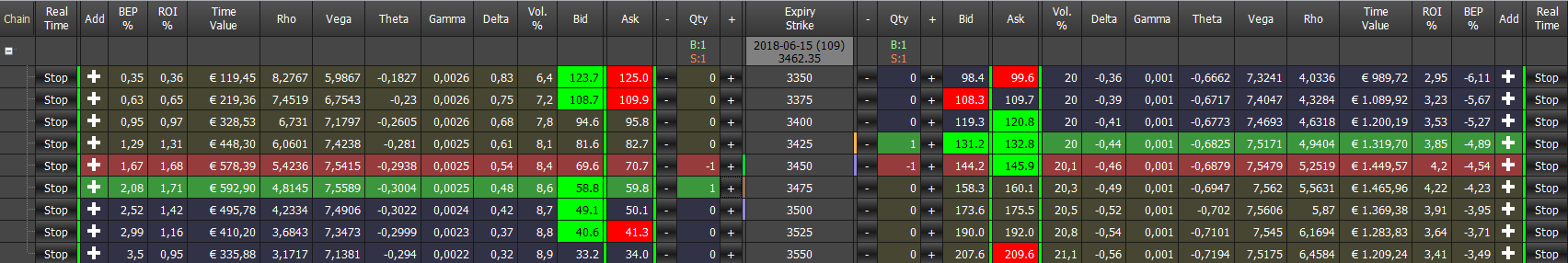

As you can see from the example above the Options Chain of Iceberg presents the strike at the center, the column of Call at the left and the column of Put at the right.

If you enable the feature Call/Put Parity from Strategy Settings a green color is assigned to expiry which is possible to calculate the moneyness, a red one if don't

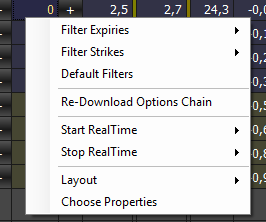

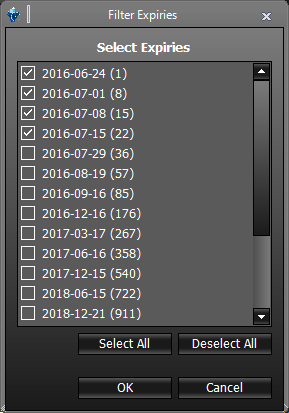

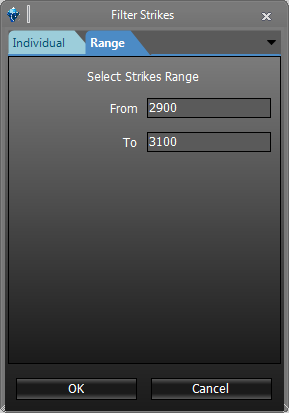

The complete menu of options chain is available by clicking with the right mouse button anywhere on the chain options.

In “Custom” is possible to choose both expires and strikes.

|  |  |

Note: The list of strikes and expires is provided by the broker. If you find any discrepancy control the encoding of the symbol in Symbol Manager

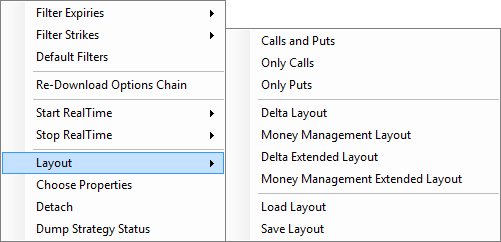

The Layout section of the menu allows the user to customize the Option Chain . There are basic layout as you can see from image, but you can save and load as many layouts you want.

| Delta | shows strike technical details | |

| Bid/Ask Hits | shows il the contracts are traded traded on bid or on ask from market open | |

| Money Management | shows strike monetary details | |

| Delta Extended | shows strike technical details and greeks value | |

| Money Management Extended | shows strike monetary details and other values to money management | |

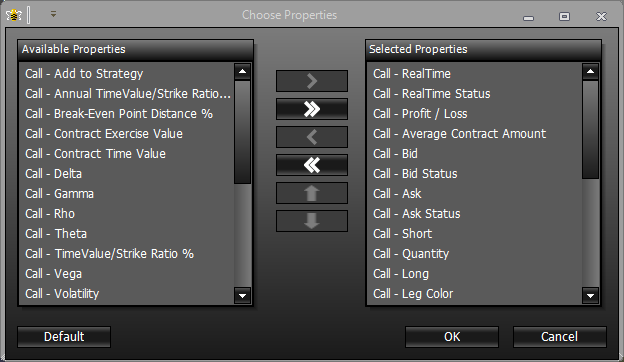

You can open the window choose properties through right mouse button

For a list of available properties and their explanation, click qui.

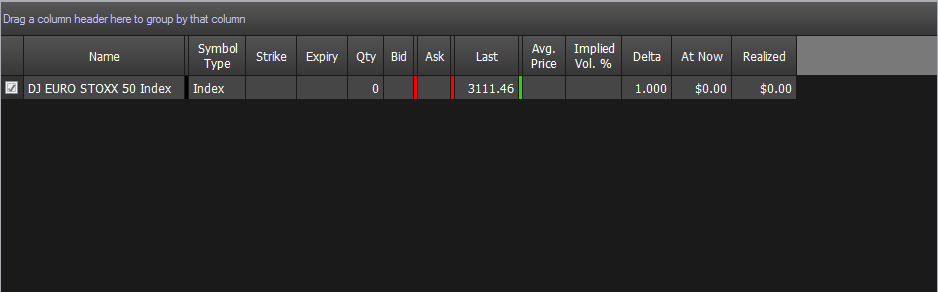

Once you have chosen the underlying it will appear in the area where will be listed all the legs of the strategy.

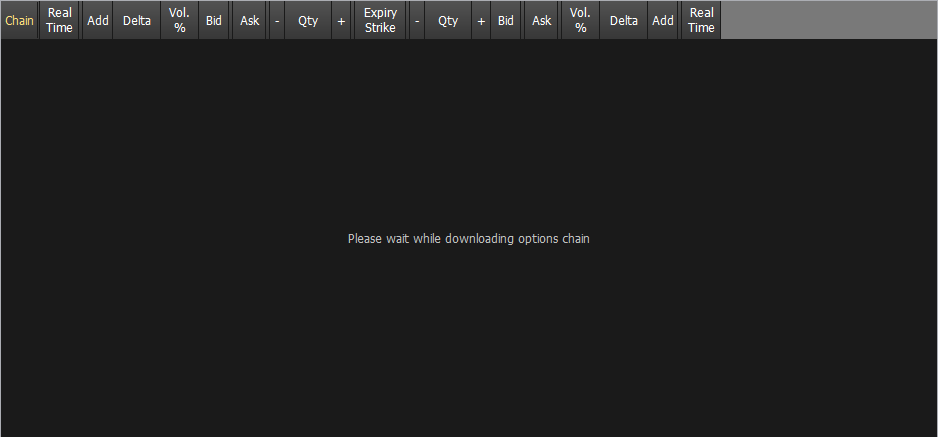

Iceberg once the underlying is selected automatically proceeds the download of Chain Opzioni, as you can see from the pictures below.

|  |

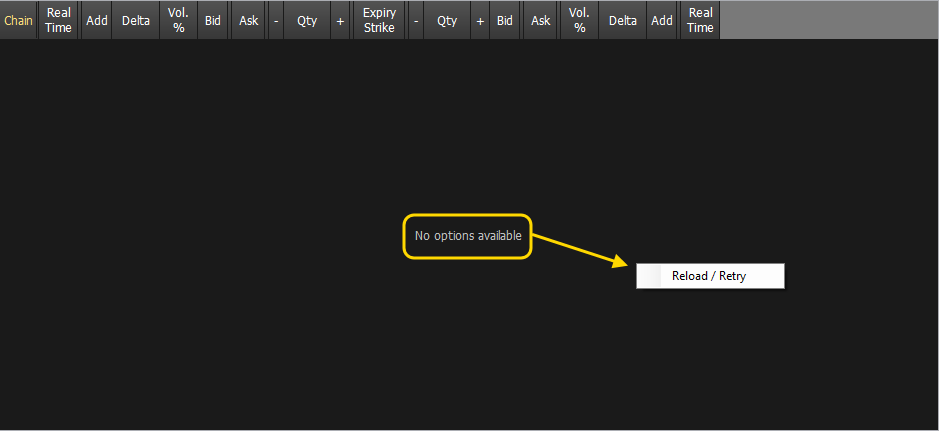

Can take place due to momentary problems in the connction that the Option chain is not downloaded. In this case Iceberg shows the message “No options available”, in this case, you just click the right mouse button on the box of the Chain Options and select Reload / Retry. It will make another attempt to download the Chain Options from the broker.

The QuickTrade of IwBank provides a special procedure for displaying long expires. The Quick Options shows just the first 6 expires, for Long Term expires you must use the advanced search. Consequently Iceberg requires an additional encoding in the Symbol Manager for long expires.

In this example notes that the options may have the same underlying but the underlying can be called otherwise, both the names have to added separeted by ;