How to use the Manual

Quick Guide

Video Tutorial

Iceberg Features

In-depth analysis

Brokers

Data Feed

Other Manuals of beeTrader Trading Platform

How to use the Manual

Quick Guide

Video Tutorial

Iceberg Features

In-depth analysis

Brokers

Data Feed

Other Manuals of beeTrader Trading Platform

Aggiungi questa pagina al tuo libro

Aggiungi questa pagina al tuo libro  Rimuovi questa pagina dal tuo libro

Rimuovi questa pagina dal tuo libro Questa è una vecchia versione del documento!

Let us now see how to proceed to the realization of a Strategy analyzing all the steps to proceed correctly.

| 24/03/2016 | Strategy - How to build a strategy in options | 6:23 |

| 24/03/2016 | Strategy - How to import on Iceberg an existing strategy | 5:59 |

| 24/03/2016 | Strategy - How to change filled price of a strategy | 2:22 |

| 20/04/2016 | Strategy - How to import positions of the broker | 2:51 |

| 22/04/2016 | Strategy - From setting of the strategy to Plan B | 18:45 |

| 20/04/2016 | Strategy - Management of Dividends | 5:40 |

Click here to watch other Iceberg Video

Once verified that the options and futures are properly encoded, you switch to start Iceberg, an app of beeTrader®. It is possible to start Iceberg by the menu beeApps and the Welcome page of beeTrader® both. If you can't click the button check the authorizations on area user of PlayOptions.it site.

In “General” you can see a large part of the necessary information.

The first thing to do is to choose the underlying on which you want to build your strategy, then in Underlying of Strategy menu, click Select Underlying

Subsequently it is shown a window to select the underlying in which appear only the securities linked to the options, so if the underlying does not appear in the list you have to connect the Options Chain to it, see Symbol Manager for the procedure. To facilitate the search of the underlying in this window there is a filtering system for each column. In the example the underlying assets are grouped by exchange simply dragging the column header of Markets on the line above.

|  |

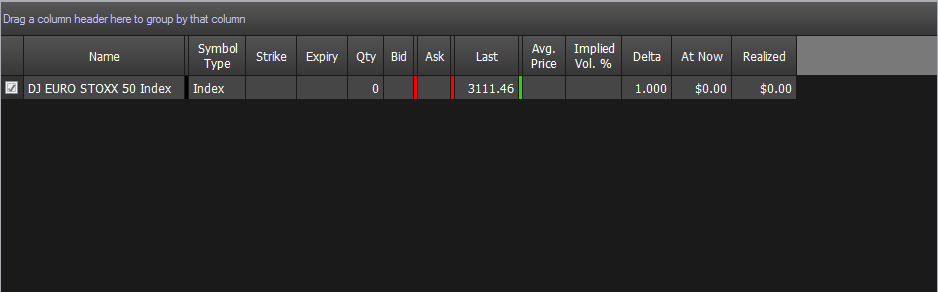

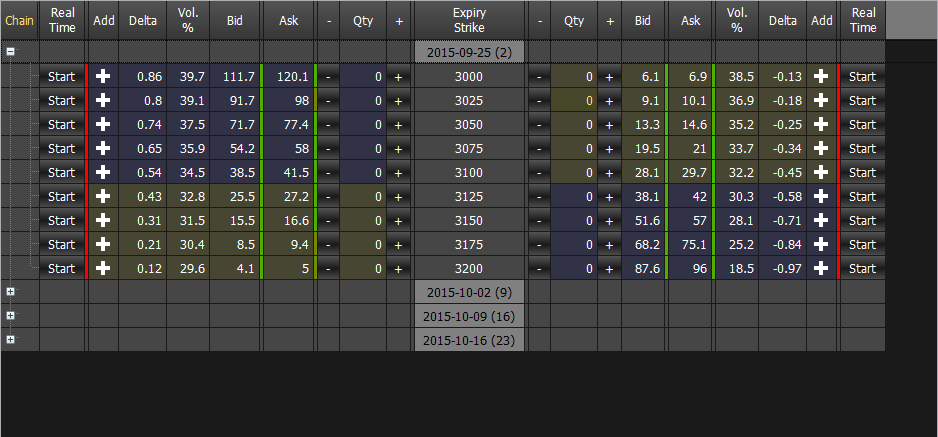

Once you have chosen the underlying you will see it in the area where you will see all legs of the strategy.

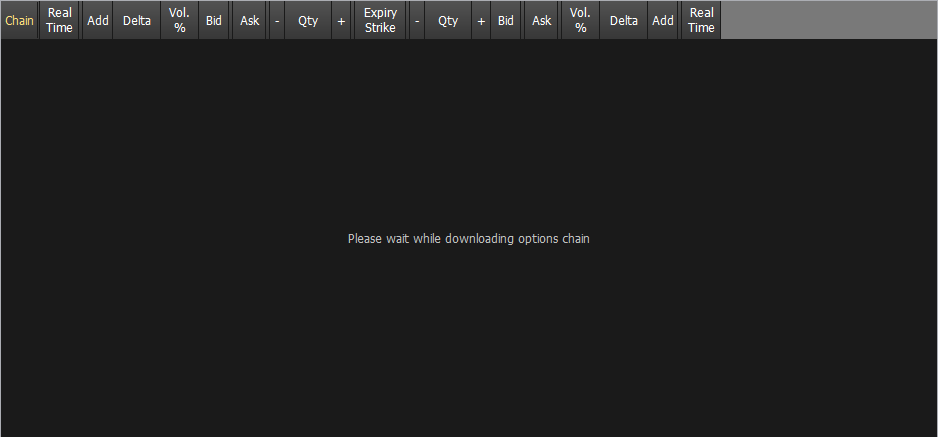

Iceberg,when the underlying is selected, automatically proceeds to download of Options Chain, as you can see from the pictures below.

|  |

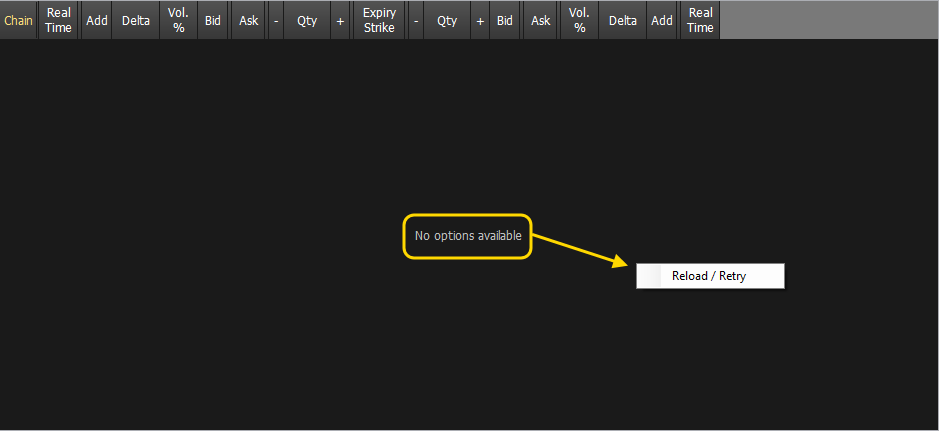

Can take place, due to momentary connection problems to the broker's platform, the Options Chain is not downloaded. In this case Iceberg shows the message “No options available” message. You need click the right mouse button in option chain section and select Reload / Retry. It will then be made a new attempt to download the Options Chain from the broker.

Well, now with the underlying and Options Chain we have to study the strategy to implement. Through the menu that appears with the right mouse button you can choose the strike and expires. To deepen the Options Chain functions, click here.

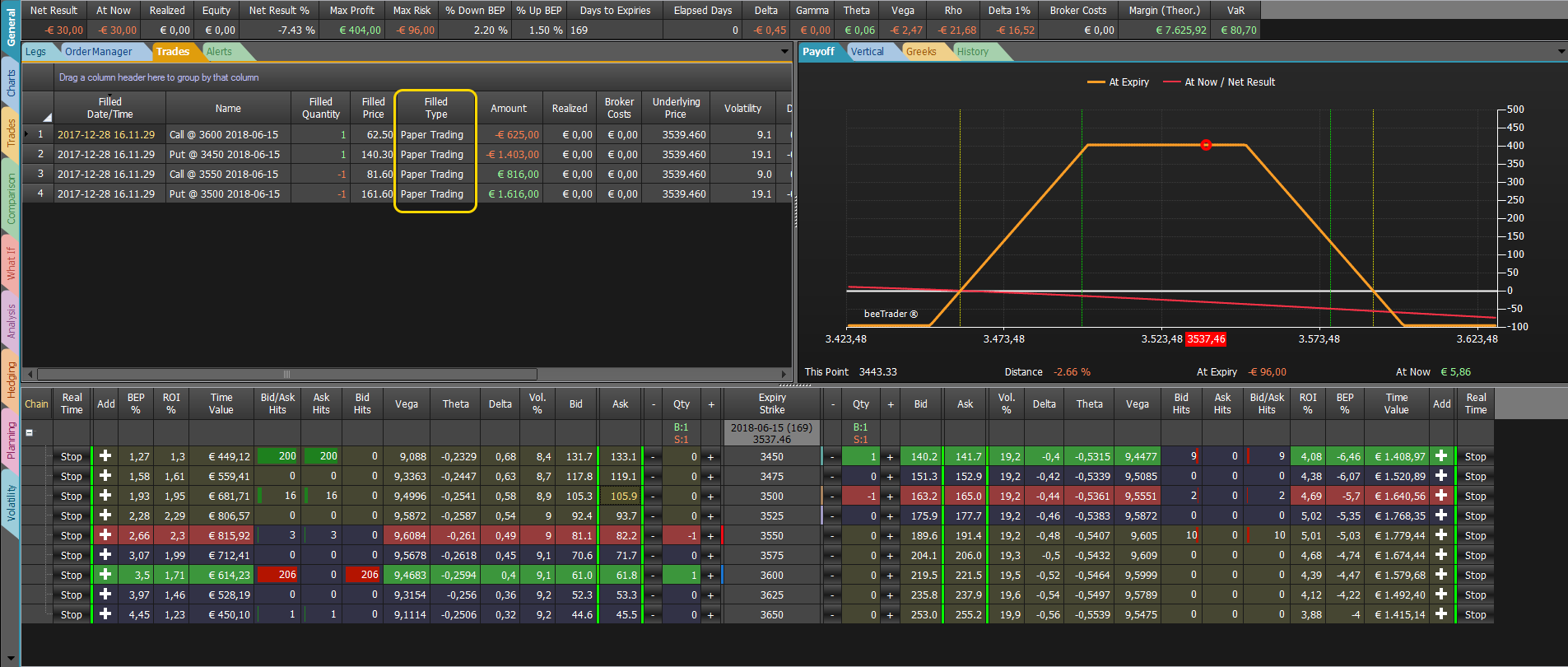

Let's say you want to make a condor, then you sell a put a call 3050 3150 and buy the put and call 3000 3200. Adding or removing options contracts in Options Chain the payoff changes accordingly. The operations are highlighted in blue in the Trades and in Legs , this indicates that the operations are still to be finalized in basketball. In Payoff the Breakeven Points are shown in red color. The standard deviation are shown in green color. This is a default configuration that the user can change at will, for more information on the functions of the Payoff Click here. All properties of the options readed in Legs and Trades are editable, for more information on the Legs Click here, and for more information on the Trades click here.

The finalization of the strategy, in Paper Trading or Real Market, through the appropriate buttons on the menu of Trading Strategy section. It is recommended to read the section of the manual about orders execution in Paper Trading or Real Market available here.

When the orders are filled you can see the type of orders(paper or real inTrades.

It is recommended to read the section of the manual about order execution in Paper Trading or Real Market available here.

If underlying desired is not available it must be coded in Symbol Manager with his options and futures.

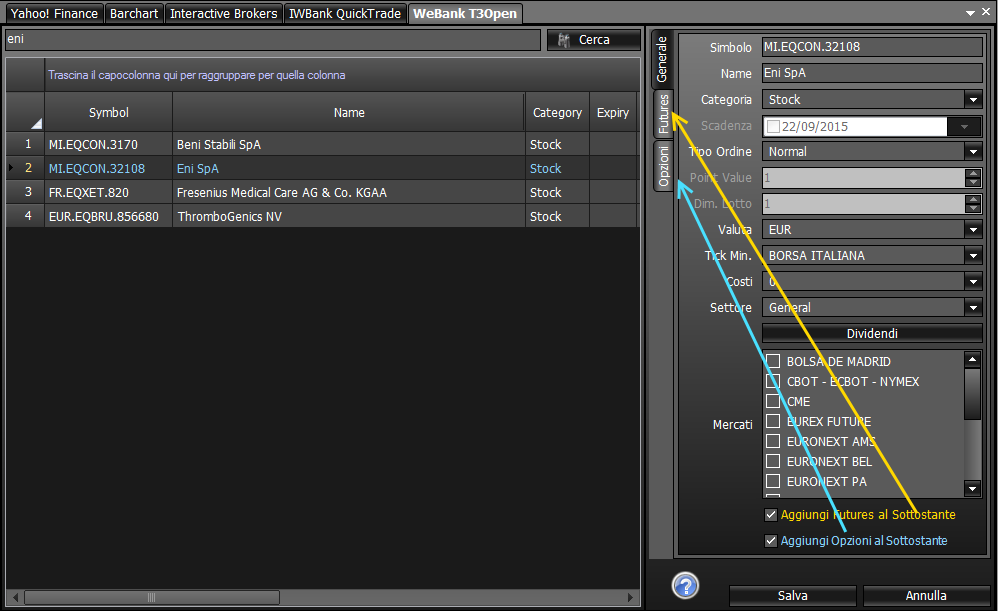

Suppose as an example to create a strategy on Eni through WeBank.

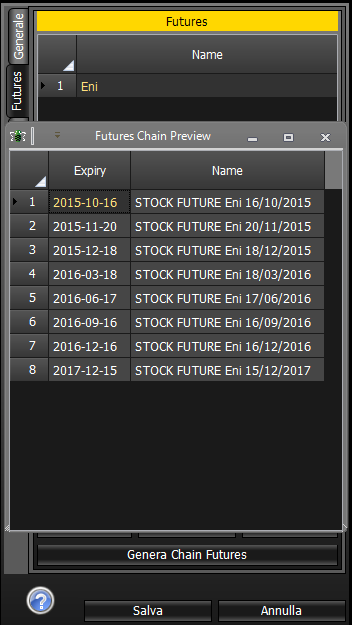

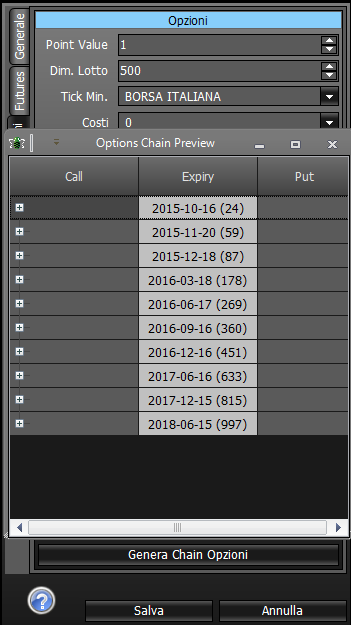

Opening the Symbol Manager and Eni we can see that the check boxes “Add to the Underlying Futures” and “Add to Underlying Options” are already flagged, this means that the underlying Eni is configured. By clicking on the buttons “Generate Chain Futures” and “Generate Options Chain” in the corresponding tab you can verify that the settings are correct, indeed the chain request is made to the broker platform which must be open.

|  |  |

if this does not happen, and the underlying has options listed on the broker you should be able to encode it. On beeTrader® manual there is the procedure to encode symbols for each broker: Yahoo! Finance, Interactive Brokers - TWS, Iw Bank - Quick Trade & PEI, Webank - T3 Open 8.0 .