Introduction to the Fiuto's world

In order to exploit all tool potentialities of this new, it needs to fully understand the project based on which it has been built.

The trader undertaking the road of the investments in options, needs a continuous support, the possibility to compare itself with other traders, to receive concrete and immediate answers to the difficulties that faces.

- Fiuto Beta it is the software projected and developed from sector experts in order to support with the right answers these necessities.

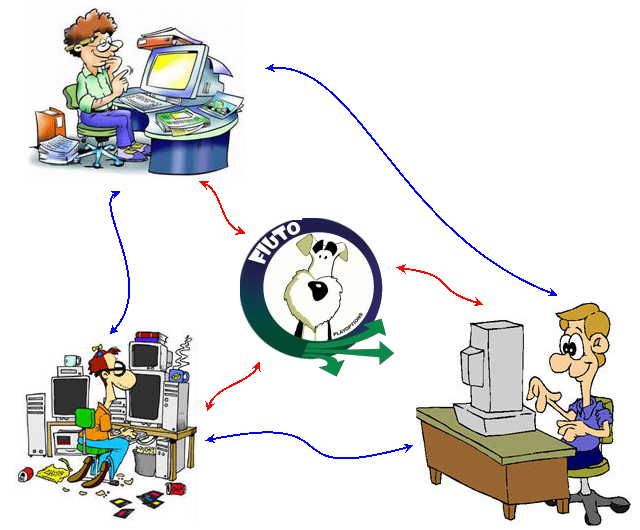

- Fiuto is interactive, born for allowing any community’s trader to share its own strategies or to send it to the Playoptions’ expert systems to get an immediate evaluation of the strategy.

- For the Teachers teachers who will apply will be freely provided with, an exclusive network. In this environment the strategies that the teachers’ staff, or the group of their clients will make available, can be exchanged, divulged, studied, introduced, followed and sold.

This sharing possibility allows to send or receive some strategies that might immediately be visualized and used, or modified and re-sent to other traders for a further study.

What will be got is a strong strategy, a strategy to which so many brains will have given their contribution.

The Fiuto’s network is built for different ability levels.

There is a first level where whoever can enter and send or receive strategies, up to the area devoted to the SuperTraders where the best traders of the world may exchange their jobs. The access permission is earned with the job: the more it is learned, better the gotten evaluations will be.

Higher the scores will be and more difficulty will have the accessible area. Fiuto provides the visualization of the mayor world underlying in order to allow Traders of different nations to work together as a team.

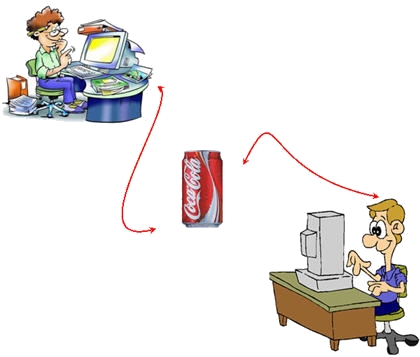

For instance it would be possible to begin with a strategy on Coke and forward it in sharing to all users. A trader in America or in Germany or in Israel might be interested to the same underlying and download the strategy on Coke.

To amend some details and to forward it back in sharing. It is clear that after each amendment the strategy will be improved and, when a discreet evaluation will also be got that might be the moment to decide to activate it taking position on the market with greater probabilities of success.

Features

- For the correct use is necessary to understand the operation of the data stream that feeds the calculations.

- The data referred to are not in real time but in late 20 '.

- The data for the graphs of the underlying and for the calculation of the options are taken from free sources found on the web and are generally lagging behind in 20 '.

- The bars are composed of the chart with this data with the exception of the bar corresponding to the day when we are effettundo analysis that is fed with data or not delayed or delayed for a few minutes (20 'maximum).

- As a general rule you have access to a series sometimes very large, even for some tens of years. Other underlying could however be provided with the most recent stories.

- For options on indices, we consider equal to the reference price index and in the future.

The main window is divided into three sections, the side will always be present while you navigate in the middle window.

The first part on the left is dedicated to the functions of updating. Starting from the buttons are:

- “Update Last ” through which we can do a refresh of data related to the bar without having to wait any time of updating;

- “Auto”, which sets the upgrade to maturity and which appears under the window of the countdown;

- “Update Graph” that allows us to update all data on the graph with any missing bars as described above;

- “Save View”, which allows us to save the image of the graph in a special folder;

- Info Stock”, which opens a web page where you will find the financial information pertaining to the below that we are studying;

The second part, on the right, refers to the control panel and consists of several partitions.

This part is common to all screens and allows us to navigate from one to another regardless of the underlying which are operational at the time.

On the top, after the authorized user information for the platform, we can read the information below at the time considered and the listing with the last recorded update. The underlying selection may occur in 2 ways:

- Using the “Search”. It will be enough to type the first letters that make up the name of the software below and we will present the hypothesis selected. By continuing to add letters make more selective the search until you reach the desired result;

- Researchers and choosing from various branches in which are arranged below.

So if the graph of Coca Cola can enter a few letters in the search - simply “coc” - or open the class action Dow Jones 30 “and then click on Coca Cola.

Just below the underlying selection is a watchlist where we can type the ticker of the underlying interest of our brief to monitor their changes.

The following Message Center will allow us to be constantly informed about initiatives PlayOptions.

NOTE : To have more space available once used, the side windows

you can “place” and close by clicking on the close button. To reopen it temporarily, there will be sufficient to move the mouse over the right edge of the window to the right or the left edge to the left. To reopen once we finally click on the close button.

The third part, in the middle, is reserved to the graph of the price and volume histogram of the selected underlying below. The upper part shows the information generated since the last update and just below other buttons allow us to access functions and specific information: from a large number of indicators and oscillators, to the various studies charts applicable, to the modification of the display of data.