Strategy - What-If

In this section you have the opportunity to check what will happen to its strategy in the market conditions that you assume. Starting from the basic strategy, you can change the date, the price of the underlying and volatility and test up to four possible future moves.

The theoretical prices used in the What-If are calculated with the new Internal Market Maker Iceberg, prices do not move only according to the user's assumptions, but also with the volatility surface to which user wants to refer. Default is always used a flat volatility surface. To use a different volatility surface, it can be loaded as explained below.

The internal Market Maker acts in the same way the real Market Maker acts under the same market conditions

Video Tutorial

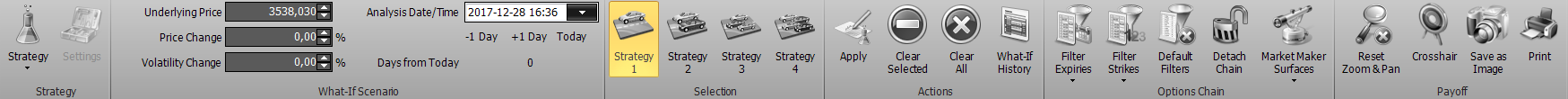

The menu

Strategy

| It open the submenu Strategy | |

| It create a new Strategy | |

| It open a previously saved strategy | |

| It saves the strategy currently in use. | |

What-If Scenario

- Underlying Price: field where to set the value of the underlying for the simulation;

- Price Change: field where to set the % variation of the underlying for the simulation;

- Volatility Change: field where to set the % volatility variation for the simulation;

- Analysis Date/Time: field where to choose the date of the simulation;

- Days from Today: field indicating the difference days of the simulation with respect to today's date.

Selection

| It select the strategy 1, by this time all the operations will be performed on this strategy and on the cyan color payoff | |

| It select the strategy 2, by this time all the operations will be performed on this strategy and on the magenta color payoff | |

| It select the strategy 3, by this time all the operations will be performed on this strategy and on the yellow color payoff | |

| It select the strategy 4, by this time all the operations will be performed on this strategy and on the orange color payoff | |

Actions

| it confirm transactions with the current settings. When the Apply button is clicked, the system saves the transactions in the window What-If History.For more information on window What-If History, click qui | |

| It delete all orders of the selected strategy and return to the starting strategy | |

| It delete all orders, practically it start a new What-If session | |

| it open the window What-If History in which are stored all operations realized by What-If | |

Options Chain

| It allows you to filter the deadlines visible on Chain Opzioni. For more on Chain Opzioni, click qui | |

| It allows you to filter the strike visible on Chain Opzioni. For more on Chain Opzioni, click qui | |

| It allows you to delete changes to the expires filters and / or strikes and return to the default display | |

| It open the submenu Market Maker Surfaces the tool that allows the processing of the volatility surface on which theoretical prices are calculated | |

| It start the window Market Maker Surfaces for the selected underlying and it acquire the current market volatility surface | |

| It starts the window Market Maker Surfaces for the selected underlying and it allows to use previously saved strategy | |

| It save te current surface for future use | |

Payoff

Example of What-If

1. Suppose we have a strangle on DJ EURO STOXX 50 Index with the underlying at 3529,22, therefore -put 3500 e -call 3500 on expiry 06/2018.

2. Switching on What-If tab we can see that all properties (main strategy and the four possibilities of what-if, are equal).

Note: in the transition from the General tab to the What-If tab the option values are not the same, this difference is due to various factors such as the bid / ask spread and volatility. To have more precise values, acquire the volatility surface. In any case, a difference in the order of 20% can be acceptable as it will be produced throughout the simulation.

3. For example whether the price going to 3675 on 15/03/2018? With Iceberg you can answer this question simply by setting the desired parameters in the What-If Scenario menu.

4. The put 3500 gains 1032,00€ while the call 3500 losses 966,00€. At this point you can use the four strategies available to study whats you would do

5. In the upper section of the What-If the properties are displayed for all four possible changes. You can view them individually or simultaneously on the payoff simply by toggling the Strategy from the right mouse menu

6. Once you decideded the change of the strategy (we suppose the strategy 2, the magenta one) you have to click on “Apply” button, Now the change is saved and you can procede with a new simulation step.

All changes made to the starting strategy are saved inWhat-If History, where a new section will be created for each step (Apply) of What-If performed on the strategy.